Choosing an investor beyond cash

You might be tempted to think that as a startup you don’t have much of a say when it comes to financing and choosing an investor. Since you need funding, that doesn’t really put you in a position to be picky. But here’s the thing. You choose the investor as much as the investor chooses you. In fact, you should take him through some sort of due diligence process too and analyze what he can bring to your startup beyond cash.

For a startup to succeed, more so in the case of those with first time founders, cash is only a small part of the recipe. You wouldn’t follow a recipe for stew if it boasted to enchant your guests, but in the ingredients list you’d find only beef and potatoes and no instructions whatsoever, right?

1. First and foremost, understand what your options are

What’s lacking in your startup? Do you need a bigger and more connected network? Is expertise something you’d need? Your startup’s different needs can be solved by different types of investors. Once you have your MVP, you’ll probably get in touch with angel investors. They are a good fit for startups at a very early stage. Especially because they bring expertise to the table. However, they do not have the resources a venture capital firm has. On the other hand, a VC will need a lot of data before deciding to back your startup. So analyze where your startup is and put all your options on paper.

2. Understand what role the investor will play in your startup

Investors are more than just walking cheque books. They have been in the industry a while. They come with the experience of looking at and investing in thousands of businesses. Choosing the right investor can mean great help in managing your capital, optimizing your infrastructure, keeping your budgets in check and so much more.

Consider the fact that most investors will have a seat on your board. Wouldn’t you rather have a partner who can provide valuable guidance without challenging or questioning your every step? This is why choosing an investor beyond cash is one of the most important things you’ll have to do as a founder.

3. Check if the investor has the basic foundations to help build your business

The right investor is the one that has previous experience and connections in your area, be it finance, health, biotech, software, etc. An investor who’s never worked with your industry will probably fail to fully understand the status quo, the market, the competition and will not be able to steer you in the right direction. In the end, an investor who focuses purely on software will most likely lack connections in the health or biotech industry.

The right investor can leverage their experience and connections in the market, not just the investment scene. They can connect your startup with other startups in the same market with complimentary products. Moreover, they can connect startups with market leaders or with enterprises that can use the startup as an innovation hub. Offering a network for recruiting professionals that have market expertise is also important.

"Your ability to attract, evaluate, and forge strong working relationships with co-founders, early employees, and investors often mean the difference between failure and success."

- Clara Shih, Co-founder of Hearsay Systems

4. See if the investor or venture firm are actively supporting companies in their portfolio

Head over to their webpage or to Crunchbase and look them up. See what companies they invested in. Check how those companies did later on and reach out to their founders for feedback.

Meeting other founders in your industry can be of great help. And your greatest chance to make that happen is if your investor or VC firm introduces you. If you are a first time founder, learning from peers is incredibly important to prevent mistakes.

5. Make sure they believe in you as a founder and in the management team

While your idea can be unique and it can dazzle an investor, you need to keep in mind that implementing that idea will fall on your shoulders and the shoulders of the management team. If your investor needs a lot of convincing that you can make it happen, he might not be a good fit.

Moreover, if the investor needs to explain time and time again how you and your startup operate, perhaps you should move on. Finding an investor who understands exactly what your startup is about can save you a lot of time and failure in the future. Trust in you and your team should be an implicit part of the deal and it is non-negotiable. An investor who lacks trust is an investor who will question your decisions.

"Don’t assume that borrowing lots of money can make your startup fly. There are many things to the business other than investors, and it’s possible to succeed with your startup without breaking the bank."

- Barnaby Lashbrooke, Founder of Time Etc.

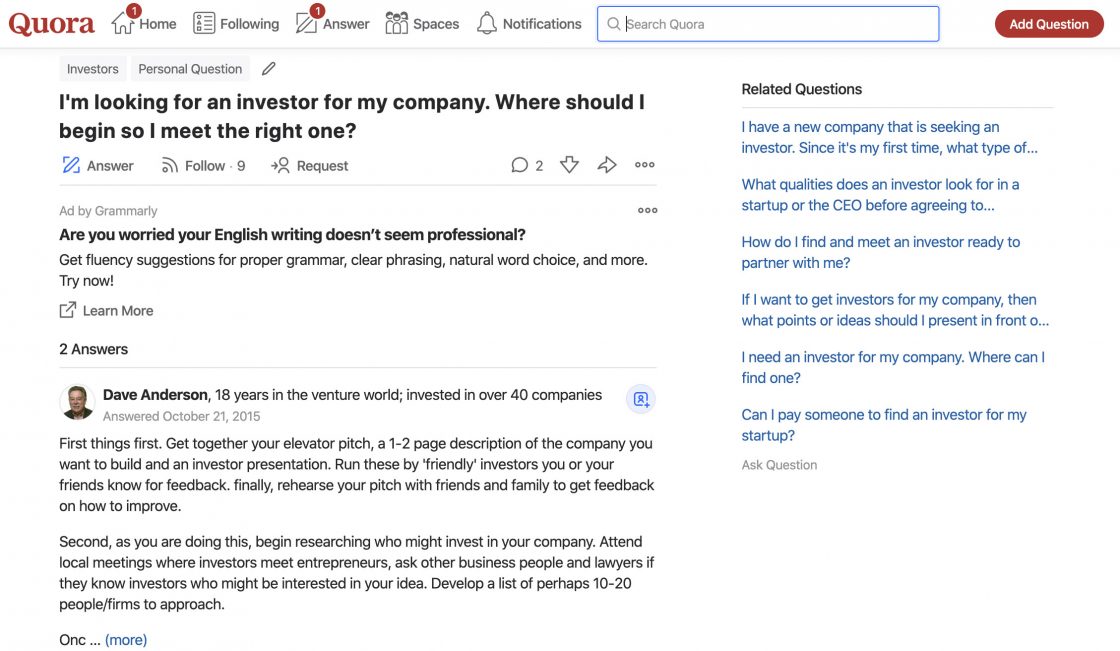

6. Do your due diligence. Check the less traditional references too

Good and true VCs and investors will share both the successes and the less successful situations. Regardless of the reason, an investment that hasn’t turned out how everyone hoped should be one that you check out for a simple reason: it’s all easy and peachy when it’s going good, but rough times speak volumes about the true colors of your partner's character. Talk to the founders whose companies did not do well and only then move on to the successful startups in your investor’s portfolio.

Additionally, remember that many investors have blogs. Head on over and check them out. Also, make sure to see all available interviews with your potential investors on YouTube.

As part of your due diligence process check the investor’s twitter and LinkedIn feeds, see if and how they spend time on Quora and Reddit. Check how they see business and life in general.

7. Look at the investor’s soft skills as well

The partnership with an investor is like marriage. You choose each other and you are in it together for better or for worse. At least for a couple of years. So you should like and respect each other first as people and only then as professionals.

Any serious investor will elaborate a profound due diligence. And he will spend a lot of time with you as part of said due diligence. You should use that time to do the same. Provided, of course, that your point of contact during the due diligence is the same one who will be responsible for you further on.

A good investor is more of a coach than an opponent. His job is to challenge you towards better results, not to question you. Any new investor should be a good fit in terms of team culture and attitude.

As a startup founder, you should remember that choosing an investor is just as important as building the right team. And it’s not about who has the biggest pockets. It’s about who has the right tools in those pockets.

Other useful resources:

- The Best Fundraising Option for Disciplined Entrepreneurs

- 11 Podcasts for Startup Founders

- Starter Kit for Startups Looking to Automate Marketing and Sales

- Starter Kit for Startups Looking to Automate Operations

Profile of Successful Founders and How to Spot Them Early On

It is a common myth that most entrepreneurs who find success are young. Some of the most successful businesses today were founded by young, visionary entrepreneurs like Steve Jobs and Bill Gates. But is this phenomenon wide enough to be viewed as a pattern and create a common profile of successful founders? Fortune.com has actually asked a similar question, looking at how you can identify founders even before they know they are founders.

In fact, some funds develop software to aid them in finding the rising stars of the startup world. Signalfire has created Beacon Talent, an AI-based system for identifying and sourcing talent, which takes the pressure off manually researching candidates.

For VCs, the management team of a startup is one of the essential elements they consider before deciding to invest. Sometimes the team is more important than the idea or the product itself. A creative, driven and experienced founder is a bigger guarantee of success than a good idea. Mainly because the business is the founder. At least in the beginning. He chooses his team and he manages everything about the startup. According to failory.com, 18% of startups fail because of team problems, some of which being lack of domain knowledge, lack of marketing knowledge (and plan), lack of technical knowledge, and lack of business knowledge.

While there are some common traits that ideal founders have, there isn’t enough data to compile a profile of successful founders today. But there are some signs you should look out for before you choose a startup to invest in.

How to spot ideal founders early

It is all about doing your due diligence even before meeting the founder and seeing the official presentation. It’s easy for anyone to make a good impression in a 30 minutes call or a one-hour meeting. Founders know they need to be on their best behavior, some of them even know what you as an investor want to see and hear. And most of them will come prepared with a good business plan, a good elevator pitch, a great presentation of the team and grand future plans. But are they for real?

-

Look for the founder’s profiles on Social Media

If you’ve found a promising startup, take a look at the founder’s profiles on every Social Media channel available. Most founders will be on LinkedIn, some even on Facebook and Twitter. On LinkedIn you will most likely get to see the professional side of the founder. This is where you will find information on how he views business and how he interacts with peers. Facebook and Twitter could tell you much more about the actual personality of the founder and his behavior as well as his management skills. A startup is only as good as its team and a team is only as good as its manager. Being a good manager is a mandatory element in the profile of successful founders.

-

Asses the experience the founder has

A founder with previous successful business experience is more likely to succeed than a first-timer. Usually, experienced founders will build an experienced team around them and will know how to manage said team in order to build a business that thrives. You can easily find details about their experience on the internet via Google search or the founder’s Social Media profiles.

-

See how the founder interacts with potential customers

The one single necessary element for a business to be a business is to have a paying customer. But for a business to be successful it needs many paying customers. While the product can be great, if the customer service is poor, things are bound to go south sooner or later. As an investor, the first sign of a potential customer service issue can be spotted in the founder’s interaction with potential customers over Social Media or product review platforms. A good founder will take into account user feedback without getting defensive or even aggressive. And a good investor keeps an eye out for this when building his ideal profile of successful founders.

-

Understand how the founder’s values could clash with the business’s values

Inevitably the values by which a founder guides his life will transfer to the startup. His beliefs will shape and form each aspect of the business despite what the official presentation says. This is a huge watch-out especially in the case of startups with co-founders. Not sharing the same values will lead to issues that will derail the focus from growing a business to internal fights. Again, you can read these values between the lines of Social Media posts, interviews and any other public information about the founders.

-

Understand how the founder reacts to failure

In the world of startups failure is common. You test, you fail, you improve. This leads to better products, better processes, better team and a high level of resilience. All of which are mandatory for a startup to be successful. Founders who embrace failure are open to learning and improving. They ask questions, they admit to lack of knowledge and they are always solution oriented.

The profile of successful founders

- The most important trait of a founder is being able to spot problems within a market. Without this, that startup’s chances to succeed are slim.

- Ideally, a good founder has previous business experience. Even if it is a failed business. Compared to first time entrepreneurs, they’ve already made mistakes and chances are they will not repeat them.

- The founder is a leader before being a manager. Someone who micromanages has very poor chances to create a positive work environment which is key to a successful startup. The founder needs to be a leader first. He needs to inspire his team, be solution oriented, and keep everyone motivated through the usual failures.

- He is open to constant change. Most likely the idea he started with will change and he will have to pivot the business model several times before he finds the product or market fit. A founder who is flexible and embraces change easily has greater chances to build a successful startup.

- He has a vision beyond making money. Building a startup is consuming and having only money as motivation will not get a founder far. They need to have a vision and a clear image of how their company will change or improve the world.

What are your methods for identifying successful founders early on? Let us know in the comments section.

Other useful resources:

- Pitfalls to Avoid When Choosing Startups to Invest in

- Deal flow to investment decision. Can we automate early stage investments?

- Disciplined Accelerators Series

Pitfalls to Avoid When Choosing Startups to Invest in

In the past years, movies and glam articles have portrayed unicorn discovery as a piece of cake endeavor. The same goes for other high-return investments. Consequently, honest materials about what drives VC decisions and about choosing startups to invest in are rare.

Of course, we’d love to say that any investment decision you make as a VC should rely on data. The reality is that when it comes to the early stage of investing, data is hard to come by. Most startups only have qualitative research, if they have any. Most of them haven’t even really gone to market. This makes it hard to evaluate them properly. Another market reality is that startups have trouble collecting and reporting data. This is something we have discovered while researching our Disciplined Accelerators Series.

Without enough financial and conversion metrics there isn’t a certain way to model the business and figure out possible returns. Simply said choosing startups to invest in is a hard job. As a consequence, VCs have developed their own ways of evaluating startups, based on founders, product, and market.

Why it’s important to avoid failure

We found some interesting information regarding failure rates of scale-ups. Statistics coming from Venture Capital funds are mostly concerned with real, innovative, scalable startups. However, venture funds invest mostly in growth-stage startups, AKA scale-ups. They are true startups, but most of them have gotten past one of the biggest risks for startups: the search for product-market fit. They have tangible proof that people want what they are offering (this proof is how they attract venture capital).

This means that their failure rates would be lower than the failure rate of early-stage startups. Harvard Business School lecturer Shikhar Ghosh says in a WSJ article that 75% of venture-backed companies never return cash to investors and in 30-40% of the cases investors lose their whole initial investment (he works with a dataset of 2000 venture-backed startups).

That said, only 0.05% of startups get VC funding (Source: Fundable), so this statistic is not applicable for the vast majority of new businesses, especially if they are in the early idea stage.

1. Investing based on personal experience

While we cannot argue that experienced VCs have developed a way of intuitively working out which startup would make a good investment, this model is not replicable or scalable. For someone looking to grow their firm, there is a great need for replicable systems. This way, the juniors that come in have a proven way of choosing well and bringing returns. When choosing startups to invest in, a VC firm must have something more than the experience of veteran investors.

2. The spray-and-pray approach

This approach can work for big VC firms with unlimited resources. But in the long run, even they have issues. Think about recession periods and an unforeseen crisis. Sure, if they’re not involved in any post-investment work (like angels and accelerators) spray-and-pray makes sense. Since all efforts go into sourcing, scouting, and closing with no further work, it’s a good strategy.

However, for smaller firms spray-and-pray is costly. It may be a “diversified" strategy for choosing startups to invest in. But each deal takes about the same amount of work no matter how much you invest. Hoping that if you place bets on enough companies, you'll eventually strike one with a very large return should not be the philosophy you apply. Especially if you really want to be successful.

3. Sticking to traditional discovery methods

Any investor out there would love to beat the market. In fact, many pride themselves with ways to do this, from special gut feelings or being smarter than the rest, to simply outworking the other person. Think about it. An investor comes to a simple, obvious conclusion based on the market and their own experience. Chances are, someone else is coming to the same conclusion as they have access to the same information. To make sensible investments, VCs need to upgrade their game. They need to dig deeper, get complex, and try to get more data. Even if the data at hand is scarce. There are many tools out there to use. In fact, many VC firms are already developing their own software and tools to identify the right investments.

Discovering the new hot startups to invest in today moves beyond traditional methods, and is enhanced by better tools, automations and processes. After all, VCs are driving the new tech advancements across the board, and surely they need to also join the tech revolution themselves.

4. Waiting for startups to gain business traction

Early stage startups will not be revenue positive. This is simply the truth. But there are signs that can let VCs know whether the startups are a good investment or not.

Choosing startups to invest in begins with a good idea. The startup has to be about a good idea. But it goes so much further than this. We all know they are a dime a dozen. However, if the ideas are not backed up by data and the right founders, the startups cannot grow into a business worth investing in. Promising startups also have good business planning. Part of this is setting up processes and not skipping important steps. From market analysis to growth plans and marketing strategy, they can all offer you relevant data. To know if a startup has processes in place it’s enough to look at their website, Social Media channels, blog and the profiles of the founders, and to ask for some data. Gather all this data in one place and work out if the startup’s way of doing things is about chaos or processes.

5. Receding investments in a recession

Tough times breed great business ideas and some of the most persevering founders. If a business thrives during tough times, it will surely fly during good times. Even if the economy is uncertain, don’t recede your investments. In the end, you’re not investing on a few months horizon. Your returns will show years from when you invest and years after the crisis has passed. Keep this in mind during turbulent times.

6. Not being hands on

Apart from funding, startups need access to investors’ networks. And especially to their knowledge. Simply investing in a startup is not enough to ensure returns. Many founders aren’t experienced. Many founders have invested all their time into planning and developing their startup, not into growing a network. Supporting a startup with more than finance increases its chance of success. Obviously, it increases your returns too. When choosing startups to invest in, make a plan regarding what else you are willing to invest. Think of mentors, courses, bootcamps, and software to support the startup’s growth beyond immediate revenue.

7. Relying on associates for manual tasks

Great VC firms have associates to spare. And they rely on them for most of the work. This means many aspects of the work are highly manual. But imagine what would happen if associates were upgraded from manual work to high value work. This can be done by automating most manual tasks and getting associates to work with input from those automations. As we’ve said in a previous article, automation can lead to a highly effective deal flow and due diligence platform.

These are just the first steps. Once you have them in place, you can move on to automating many other parts of your firm that will simplify the process of choosing startups to invest in.

8. Don’t make finding a unicorn your VC investing strategy

If a startup’s financial goal is to “make a billion dollars”, walk away. Rather than hunting for a unicorn, hunt for the startup’s data. Look at whatever metrics you can find and understand how the startup approaches data. This will tell you everything you need to know about the startup’s future success or lack thereof.

No matter what your experience is, no matter who the associates or the partners in your firm are, nothing beats data. Even superstar VCs have a slim chance to discover a unicorn. A startup has a 0.00006% chance of becoming a unicorn. That means three out of every five million companies. In conclusion, when choosing startups to invest in don’t make finding a unicorn your goal.

Venture Capital has been and will be an important source of financing for startups. They solve a very important challenge in market economies: connecting founders with good ideas to investors with good funds. However, Venture Capital firms need to have solid returns. This makes choosing startups to invest in a high stakes step that should be done with good processes in place. Many VCs have come to this conclusion and have developed software that takes human bias out of investing. This way, there is hard data to look at and on which to base decisions.

9 Mandatory Books for Junior VCs

We’d love to tell you that there is an easy way to learn and understand the worlds of startups and investments. Truth is, we all learn through doing. We talk to people, we test things out, we listen to podcasts where others smarter than us share their learnings. We attend talks and seminars and we read. And we read a lot. Between all of us, we have read hundreds of books for junior VCs, for startups, for angel investors. For starters, we would like to share a list of mandatory books for junior VCs. They can be useful to anyone who is just starting and wants to get a better grasp of what they are getting into.

1. Antifragile: Things That Gain from Disorder by Nassim Nicholas Taleb

Antifragile looks at a big number of mental models and shares wisdom that is hard to find in other places. The author has a unique way of analyzing markets, statistics, and optionality in this book. He explains what fragility is and what it isn’t. He also takes a look at why resilience is different from antifragility. But he also talks about the most relevant thing for a VC: optionality. In short, Taleb says that the more freedom of choice you have to respond to unforeseen circumstances, the less fragile you will be to negative black swan events. Making optionality a cornerstone to venture capital.

Why it’s relevant for junior VCs:

Taleb going into both the math and the principles of every mental model presented. He’s not just approaching things from a social or psychological point of view. He dives into the data. And you know what we always say: Data beats gut feeling.

2. Zero to One by Peter Thiel and Blake Masters

Peter Thiel, co-founder of PayPal, believes that there is still a lot of room to innovate in the world. But innovation doesn’t come from doing what we already know. Doing what we already know will only take the world from 1 to n, adding more of something familiar. He says that a new creation goes from 0 to 1. This book is about the realities of the hard work it takes to become an entrepreneur.

Why it’s relevant for junior VCs:

At first glance, this is a book that would interest founders more than junior VCs. But to be a good VC, one needs to understand it all. Successful VCs learn all there is to learn about the whole ecosystem, not only on their part. Good VCs know how a startup is built, how founders think, and what successful startups have in common. This way, they can make better decisions, based on both data and experience.

3. Lean Analytics: Use Data to Build a Better Startup Faster by Alistair Croll and Benjamin Yoskovitz

Metrics are a startup’s mirror. If tracked honestly and correctly, metrics can give investors a pretty accurate image of the business. But for metrics to get to investors, they have to be tracked. This book speaks to founders about what and how they should track to make sure they have a healthy business.

Why it’s relevant for junior VCs:

You might think this is a title you can skip, but understanding how startups look at metrics will help you make better decisions too. If you know how founders think, you know what to look for, what questions to ask, and how to spot red flags. For a VC, especially a junior VC, the decisions they take at an early stage in their career will make them or break them in the industry.

4. Venture Deals: Be Smarter Than Your Lawyer and Venture Capitalist by Brad Feld and Jason Mendelson

This book is designed to bring transparency to the venture capital funding process. It looks at the status quo of how venture capital approaches startups and how deal structures are constructed, how they work, and what motivates venture capitalists to propose certain outcomes.

Why it’s relevant for junior VCs:

As someone just starting out, a junior VC needs to absorb all information available on venture capital. Especially if they are looking to improve something. You know what they say, you can’t fix something if you don’t know what’s working and what’s not.

5. Break Into VC: How to Break Into Venture Capital and Think Like an Investor Whether You’re a Student, Entrepreneur or Working Professional by Bradley Miles

Bradley Miles gives the world a good book about breaking into the venture capital industry. He boldly dives into explaining the mysteries of the industry and provides approachable advice on how to enter the industry and how to succeed in it. It is a very comprehensive “how-to” material and we love it because Miles also talks about the key metrics that matter to VCs. Company performance metrics are, in our opinion, one of the more important things to look at. Other topics detailed in the book are: the stages of venture investing, accounting fundamentals; returns, and valuation.

Why it’s relevant for junior VCs:

Bradley Miles not only explains the industry very well, but he also offers solutions to many challenges. Moreover, there are case studies on young VCs. This book is a valuable addition to any new or aspiring VCs library.

6. eBoys, The First Inside Account of Venture Capitalists at Work by Randall Stross

This book is one of those rare accounts from true life. Randall Stross tells the story of the six tall men who backed eBay, Juniper, Priceline, and other billion-dollar startups that are transforming the Internet and the economy. The author was privy to the conversations where the Benchmark boys debated which businesses to support. The book may not be filled with data, but it is a great place from which to learn how the old world of venture capital worked.

Why it’s relevant for junior VCs:

The book offers a pretty real image of the VC industry and it describes a glorious period: Benchmark Capital in the middle of the Internet wave. You get a great idea of how investors think, and how they make decisions. But you will also understand how venture capital firms are built.

7. Venture Capitalists at Work: How VCs Identify and Build Billion-Dollar Successes by Tarang Shah and Shital Shah

If you were looking for a collection of insights and approaches of leading VC practitioners, Venture Capitalists at Work is the book for you. You will learn a lot about the personalities of prominent VCs from the current generation, including Jim Goetz and Alfred Lin of Sequoia and Rich Wong of Accel. The book is, in fact, a collection of interviews that display the true colors of the venture capital process.

Why it’s relevant for junior VCs:

Understanding how seasoned VCs think can be a real advantage to any junior in the industry. Apart from the valuable knowledge and lessons, juniors can get a better grasp of the expectations of their future bosses.

8. Term Sheets and Valuations by Alex Wilmerding

It may have been written some time ago, but this book is still an amazing primer. It should be on the list of mandatory books for junior VCs, entrepreneurs, and financial professionals. The greatest part is that this book includes an actual term sheet. It is from a leading law firm and it features line by line descriptions of each clause, what can/should be negotiated, and the important points to pay attention to.

Why it’s relevant for junior VCs:

This book can get you up to speed on how venture deals work, including terms types of preferred stock, governance rights, and different wants to value an early-stage company. It can help you develop a better decision-making mindset.

9. Angel by Jason Calacanis

Jason Calacanis offers good insight on how to evaluate entrepreneurs, build deaflow, build a calling card as an investor, and avoid investing mistakes. While he talks about them from an angel perspective, they are valid for VCs too. Calcanis invested in Robinhood, Wealthfront, Uber, Desktop Metal, Datastax, Thumbtack, Superhuman, and Trello. He is also the host of This Week in Startups, a show we’ve mentioned in our article about useful podcasts for startup founders and VCs.

Why it’s relevant for junior VCs:

Calacanis offers a great investment process and framework for angel investors. So if you are considering investing as an angel before entering the venture world, this book is crucial.

What are some other relevant books we might have missed? Let us know and we’ll add them to this list.

Other useful resources for startup founders:

- 11 Podcasts for Startup Founders

- Starter Kit for Startups Looking to Automate Marketing and Sales

- Starter Kit for Startups Looking to Automate Operations

Why You Are Tracking the Wrong Metrics For the Wrong Purpose

TL;DR: Your management board should work with lagging metrics. Your team should work with leading metrics

People say I’m a process freak. This means that if a process works, I try to break it to make it better (it doesn’t always work out this way). It’s an obsession with quantifiable stuff, outcomes, and data visualization—regardless of whether I work with my team or help other startup founders. I track all sorts of data, have a detailed OKR process that works (and continuously changes) with my team, and have a business partner, friend, and co-founder (Vlad) who is as obsessed with data as I am. Or more. Yes, we are aware that we are weird and that there is more to life than metrics.

Like many other businesses, we got into measuring performance with noble intent, inspired by the priceless and timeless advice of THE management guru:

If you can’t measure it, you can’t improve it.

Along the way, we ended up doing it out of inertia, mindlessly tracking numbers, and looking at beautiful charts. Kind of like the Netflix of business intelligence. We were tracking a lot of metrics with funny names—MRR, LTV, CAC, COGS, and many others. Just because others were doing it too.

But one day, by the time we were starting to build Metabeta, it struck me that this was stupid. The metrics gave us information, but not much improved. Shortly after, we changed the way metrics are part of our business processes. I’ll sum it up in a very simple way, before going into more detail:

When you choose a metric, don’t ask yourself what information it will give you. Ask yourself what decision it helps you make.

Some definitions

Before moving on, let me get back to some definitions so that we use the same terminology.

- A metric is something quantifiable and measurable. There are two main types. Flow metrics measure something over a period of time (eg. Monthly revenue, Weekly Active Users). Stock metrics are a quantifiable snapshot (eg Cash on Hand, Accounts Receivable, Equity). Business metrics usually fall in several categories (marketing, sales, finance, product, operations, impact, others).

- An indicator is a metric that has business relevance—i.e. gives useful business insights on a specific topic. So, if you track gross margin, but that does not give you any business insights, it’s a metric. If it tells you that there is something awkward since your product/service costs have increased despite having the same number of customers, then it’s an indicator.

- A KPI (key performance indicator) is an important indicator for measuring the performance of the company. This means that a KPI needs context first. What metrics measure the performance of the business? Which ones are key for the performance (not all are important, so not all are key). A general rule of the thumb is to keep the number of your KPIs as low as possible. All others are indicators.

Since I don’t have insights and context related to your business, I’ll be using metrics in the rest of this article.

[wd_hustle id="6" type="embedded"/]

The four metric types

These are four types of metrics that are/should be tracked by any business (startups included):

- Vanity metrics

- Lagging metrics

- Leading metrics

- Coincident metrics

Vanity metrics

Also known as PR metrics, or bullshit metrics. I’ll start with these ones because they’re the most overused and the most useless of all metrics. Website visits. New signups. Headcount. Jobs created. You track them because everyone does, or because they look good, or because the accelerator you’ve been through asks you to report them. But if you can’t tell me in the next 15 seconds what decisions they drive in your business or team, they’re just shiny stuff, good for bragging only.

One area where Vanity metrics are immediately visible and standing out is social media. Both organic and paid efforts are measured against the effect they have on the channel itself rather than the business. Page Likes, Post Likes, Followers ... they give no real insight into how well your business is performing unless you are in the business of "influencers".

Don’t get me wrong. If you track these metrics to brag or as a PR stunt, please continue to do so if they bring you joy.

Performance metrics

Also known as lagging metrics. They are most frequently tracked by sane startup founders and managers.

They are easy to measure. Revenue, MRR, COGS, Gross margin, Monthly Active Users, Churn, Billings, ACV, and so on. I bet you have a spreadsheet up your sleeve with them, and that you look at it with hope and awe, or with desperation (let’s hope it’s temporary). They are useful, no doubt. They help you identify patterns and understand the long-term consequences of your actions and plans. They are great for tracking outcomes evaluating the success of a strategy that was implemented before.

But they are not enough. They are hard to improve because they depend on a series of success factors. Revenue depends on a lot of factors—content marketing, branding, product value, sales teams, customer decision-making units or procurement, onboarding process, customer satisfaction, churn, and luck (first of all). We may fall prey to our cognitive bias and think that one action can improve these metrics, but they are only useful for retrospectives. They won’t tell the future. They don’t help you make decisions.

You can stare at your revenue charts as much as you want to. It’s not going to tell you about what you need to do tomorrow.

Decision metrics

Most frequently known as leading metrics. They are the ones that measure action and outputs, rather than outcomes. The number of social media posts per day. New customer sign-ups this week. Sales calls. New leads added to CRM. Bugs fixed. Customer tickets closed. They are relevant here and now and help you make decisions. Should we push on getting new leads or closing qualified leads this week? Should we postpone the product release? Which of X options will increase social media engagement next week?

They are easy to improve. Sometimes hard to measure, which can become a headache (so don’t track them if their value is less than the effort to track them). They are irrelevant in the long run and it’s actually hard to say if they are directly connected to the success of the lagging metrics. But without setting the right ones, without understanding the decisions you need to make, without tracking them, without using them to make decisions, it will be hard to increase the performance of your business.

One way to make these metrics more relevant is by adding "annotations" to the charts. If anyone looks back, and sees the development over time of some of these metrics, without the context, there are few decisions to be made. They are good for soothing and comfort when you are heading up, and for triggering an alarm when going down, but context is key here. An annotation log, history log, or as we use in Metabeta "weekly OKR log" helps the viewer go back to a story of what happened in a certain period, and understand the background of growth/decline. This is useful for decision making.

Coincident metrics

Also known as benchmarking metrics. They are not your business’s metrics, they are related to the external ecosystem—because no business grows in a vacuum. These help you understand market forces, overall or category economic dynamics, and competition. Their most important use is in comparing performance or goal setting. Your performance can look amazing compared to past performance, and lousy when you compare it with your competitors. It can help you gauge your lagging metrics and get extremely useful insights.

My favorite example is the Lipstick Metric, by Leonard Lauder, the founder of Estée Lauder Cosmetics. He discovered that an increase of small luxury items such as lipstick indicates an oncoming recession. He’s right, look at the data today!

(Special note here for SaaS startups: Nathan Latka’s website is a goldmine of benchmarking data for any subscription business. It helped us understand growth, valuation, and much more).

Ok, thanks for the theory, but now what?

I won’t leave you with something that just makes you smart, without giving you some practical hints on how to set the right metrics or re-evaluate your current metrics. And, because the Internet loves step-based recipes to success, here’s my simple seven-step recipe to set the right metrics. (I’m kidding, it’s not easy at all, but what the heck, why did you become an entrepreneur anyway?)

- The hardest question: How does success look like for your startup? Close your eyes and picture it. Describe how a day in a successful business looks like in three years. Don’t use any numbers or quantifiable things. Ask your co-founders to close their eyes, picture it, and describe it. Now you’re in big trouble because things don’t look the same. Spend some time deciding on a common picture that you can all agree with.

- What can you measure about that future? What are the indicators that measure how successful or unsuccessful the future is? I know this already sounds like a spiritual retreat with mindfulness and aural stuff, but please bear with me. One thing I have learned over time is that each business has ONE key metric which can tell you if you are doing good, or you're in trouble. The problem is that you need to recycle and check a lot of metrics before finding it. A great book I once read that showed this exercise in action, and its value to the business was The Knack by Norm Brodsky and Bo Burlingham. Let’s say that you have decided that Monthly Recurring Revenue is that KPIs.

- These KPIs are influenced by specific success factors. What are the success factors that influence the KPIs? Try to apply some systems thinking theory and not simplistic causality. These success factors should be qualitative, not quantitative. For example, for MRR, success factors could be marketing reach, conversion to MQLs, sales performance, product quality, customer support resolutions, customer satisfaction, referrals, and maybe more.

- What actions improve these success factors? Let’s choose marketing reach as a success factor that may drive MRR. What actions do you believe will increase marketing reach? Maybe increasing your social media presence, or writing more qualified content on your blog, or increasing marketing spend for your distribution pipeline? By the way, if you're looking for some useful and easy to automate marketing tools, you can find some here.

- How do you measure the actions? How can you quantify their output? They won’t tell you much about performance but will tell you about progress. Performance can’t be predicted, but you can test whether the actions lead to performance. These tests are quantitative, very short term (daily or weekly), and help you make decisions and stir the ship. By tracking, for example, the number of posts on social media each week, you can understand in a few weeks how they influence your lagging indicators. If you don’t track them, it’s just going to be luck. Or bad luck. These leading metrics (which you should discuss each week, by the way), will help your team understand your and their decision.

- Where do you get this data from, to be able to track the leading metrics? As I’ve mentioned, this can be a time-consuming exercise, so re-evaluate whether you have this data or not. If the effort is too big, maybe you’re measuring the wrong output? Or maybe not?

- Go put this to work in your team. Very important insight (sorry I left the logic to the end: Your management board should work with lagging metrics. Your team should work with leading metrics. Because of lag and complexity, setting a target for a team member to a lagging metric, such as “$100,000 sales this quarter” is a secret recipe for failure. The more pragmatic and immediate metric “100 demo calls this quarter” offers a more straightforward path. One where the team member has control over it, can be accountable and make short term decisions on it.

That’s it. Simple, no?

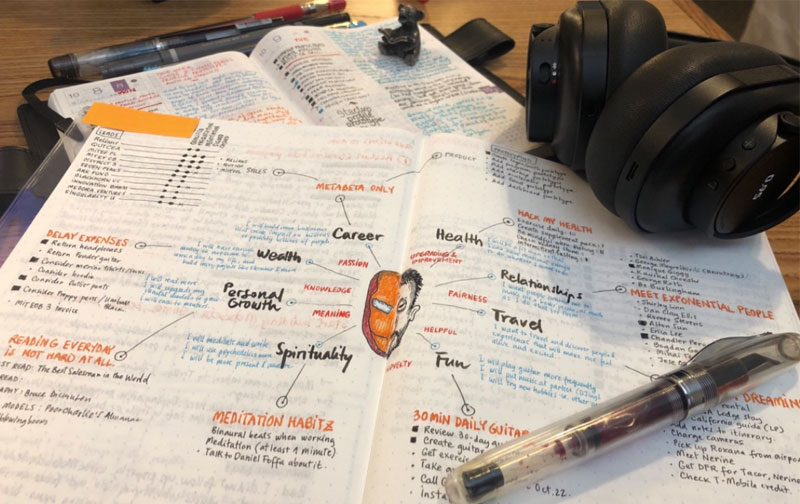

To make your life worse and your work better, I’ve shared the templates that we use to help you get from your amazing vision to the right metrics. Download it below, use it, then let me know what you discovered. What metrics are you tracking differently?

[wd_hustle id="6" type="embedded"/]

“We See Your Potential. We Don't Care If It Takes Five Years”: A Conversation with Genius NY’s Rick Clonan

Rick Clonan serves as Vice President for Innovation and Entrepreneurship for CenterState CEO where he provides high-level venture development assistance for early-stage entrepreneurs, emerging businesses, and innovation industry leaders. Moreover, he assists mentorship efforts and provides technical assistance in developing business plans, marketing plans, and funding strategies for companies that are part of The Tech Garden.

He is one of the people behind Genius NY, the largest, year-long, business accelerator program for the unmanned aerial systems (UAS) industry. It brings together some of the most promising startups at The Tech Garden in Central New York, and it is operated by CenterState CEO.

What are the uncommon best practices for running an accelerator? What have you learned with Genius NY?

We’ve learned a lot. We’ve had four years now in our Genius NY accelerator. We decided early on to focus on a very specific sector: UAS (unmanned aerial systems). In the startup world, this is very narrow and we did not know at the time how our pipeline would look like and how it would be affected.

Why did you choose this and why Syracuse? It is not one of the most popular startup destinations in the US.

A couple of things came together. First of all, Syracuse is where I retired from my 20-year Air Force career. I ended my career at an Air National Guard Base for the first Air National Guard. They are the first Air National Guard Base to go from F16s, from manned aircraft to drones. Being there, we were the first to do it, so we have that skill set. General Electric, Lockheed Martin, and others were interested in this sector and there was a lot of organic growth in military electronics, radars, sensors, and even unmanned systems. At the same time, the FAA set up seven sites in the US to explore how drones integrate into the national airspace. And we are one of those sites. All of this made me believe that maybe we have enough organic support to go ahead and focus on UAS, UAB.

From what I know CenterState CEO is supporting Genius NY, but did you go specifically after governmental support or other funding?

We talked to the FAA, we talked to CenterState CEO, local businesses, investors, and other agencies. We were able to obtain some grants for Genius NY from NY State. There actually was an economic development vision for unmanned systems, and I just put another piece to the puzzle. That helped us with the focus. Focusing makes everything so much easier. It really helped us on the pipeline.

I know exactly what trade shows to go to, exactly which magazines people read, which websites are relevant and we can dedicate our advertising dollars right there. When you're doing a general incubator or general accelerator, you have to really spread around your budgets and try to hit a little bit more of a shotgun approach. For us, the pipeline was easier. The resources were easier and team building was easier because when I built the team, I built on their experience in those areas. Focusing on a sector had many, many advantages.

Stay up to date!

Every few weeks, we send out a curated newsletter with articles and insights from top accelerators and investors.

By signing up you agree with our terms and privacy policy.

Why an accelerator and not a seed fund or a venture?

We looked into many options. We could have just taken economic development dollars and we could have gone to mature companies like our local Lockheed Martin, and offered them support to incentivize their mature business to expand in this area. If we look at the big picture of economic development, where jobs are really created, we realize that that's not where they are created. That money can melt away. We can convince a large company like Lockheed Martin to, maybe, hire 100 people for our UAS initiative, but studies show that those 100 people in a different division may be laid off, so the Net is Zero over many companies over time. So, we concentrated on early-stage startups.

We decided that we want to go for startups and we had to realize one important thing: we’re not in a major innovation hub. We're not in Silicon Valley, Boston or New York City, we're not in Geneva or Israel. When we actually say that we know where we are and what we can do, to us that equals a lot more hand-holding. Meaning we have to get the companies in here and we have to actually show them what to do. Because we don't have the osmosis, we don't have the ecosystem and we can't just give someone a chunk of a million dollars and expect them to know what to do.

That led us to an accelerator, where we have to package everything up. We have to package the resources and the services and say “here's how you do the business plan”, “here’s how you go to market”, “here's how you build your sales team”, “here's how you integrate technology”. The best model for us was an accelerator because we can do all that in a one-year-in-residence accelerator, and we can put all the resources on the table, the money, and make sure that everything is spent wisely.

What did you consider when you chose a duration of one year per cohort?

We tried to almost make a hybrid. We looked at accelerators, which are a lot shorter usually, and we saw that that sort of intensive instruction and intensive handholding can really get old after a whole year. This is why we decided to do a two-phase accelerator. The first three months are sort of a traditional accelerator. They are about intensive business planning, strategy, go-to-market plan, and so on. We wrap our entrepreneurs around a lot of resources to help make that happen. We offer more educators, more advisors in our own internal service.

After the three months of work, the five teams pitch to our judges and our advisors and we give the top team a million dollars in funding and give the other four teams 500.000 dollars. The next nine months are all about executing. It’s really an intensive accelerator in phase one and an intense incubator in phase two.

To get to these five teams, how many teams get into the three months accelerator?

All five of them. We took a big chance by having all five teams in the money quotes. All five know that they are going to get funded. Now, of course, they can all drop out for various reasons. But they all have a pretty good shot. They do their job, we do our job and everyone makes money.

Choosing so few startups to go into a one-year project, where you don’t know as a guarantee that things will work out, is the complete opposite of spray and pray and you have good results. How are you keeping the startups successful?

We did take a big bet on that. But we try to get the best, most advanced teams. And as we get a better reputation and as we keep going through Genius NY I, II, III, and IV, we are getting better and better teams that are more advanced. In Genius NY I, they were all very, very early. In Genius NY IV, we have three teams that are going to raise new rounds any day now, and they have been here for two months. We are looking at the long game. The Spray and Pray approach is a very short term approach to me. You put your effort into it and see if it works and if it doesn’t work, you move on.

We have Genius NY I teams that we are still helping. They have been here for four years now. It's really a long-term game and that's the difference. We think that all the teams coming in have the same potential. The industry tells them “We don't see your potential if you can't do it in one year.” But we come and say “We see your potential. We don't care if it takes five years. We’ll still be with you.”

So how many of the companies are still functional?

With Genius NY IV we are up to 22 teams. Of these 22, 20 are still here. What happens is that these 20 teams are now interacting and we have a team from Genius NY I, from cohort I, meeting a team from cohort IV, and they start working together. What I built here is a mini-ecosystem. Everyone's still being supported and now there is actually increased benefit.

What are the biggest mistakes that you made, the things that helped you learn to do things differently? How did the initial approach clash with reality?

It actually worked out pretty well. I was very surprised, but what I got from past experiences is that I understood how the ecosystem helps. The one thing the ecosystem does is help with finding people. We would go and just email our contacts and the people we know and ask them to judge or review the business plans we received and so on. Because we get about 400 applicants each year and we need people to review those business plans, to shortlist them. After that, we have to have judges interview and listen to pitches on the shortlist. For this, we needed a much larger pool than our own contacts.

I found that it is very easy to go ahead and blast an email and get a bunch of people to volunteer to do that, but guess what, those 30 judges know nothing about UAS, UAB. Maybe some of them are investors, maybe some of them are now business owners and some of them are professors. I found that you have to be very selective in who your judges and your qualifiers are. We went too generalist on the first one. And now we only have our ten go-to people who know what we are looking for. That helped a lot in the pipeline and with getting better and better teams.

Are there any other things during the program that you would do differently now as opposed to three or four years ago?

Of course. That’s how we created our internal services. It is easy to give someone a million-dollar check and then introduce them to ecosystem members, like someone from marketing, or website, or maybe an accountant, or a lawyer. But we found that we really needed our internal vetting process, our go-to people, for service work too. In that first year, we had to figure out exactly which lawyer was best for raising capital or advising on cap tables. And which lawyer was best for hiring a team and which accountant was better. Our service provider selection also had to be refined and tightened up. And now we have an internal sales center and a marketing center. We have actually hired someone to be on call and do the marketing work and the sales work for these Genius NY teams.

We have trained them in exactly what we want and how it fits in. It saves us from going out on the internet and finding ABC marketing firm or using The Tech Garden marketing firm. This is just low-level stuff, but it gets them on the right foot. All of this is the stuff that the interior needs because if you're in a major innovation hub, everyone knows who the best lawyer in town is to go raise money. Everyone knows who the best accountant in town is for a startup. But here in the interior, we don't know that, because there is not as much deal flow.

Mentoring is a very diverse and controversial aspect of many accelerator programs. What is the role of mentoring from your point of view? What works in your case and what doesn't?

One important thing we found is that trying to get a mentor too early does not work. Mentorship is intense. It requires a lot of volunteer work, a lot of hours. It requires a commitment. If a startup is still in the accelerator and still trying to figure out where they're going to go, then they're not ready for mentorship.

We divide our industry-experienced people into two groups: advisors and mentors. Advisors can come in and out and they can help on specific things. If someone needs help on a certain technology like control system for a drone, we would know exactly who to go to and they might do two one-hour meetings and get the person right on track. Another advisor might be someone who is good at cap tables and they could do a workshop for us or come in and help one group on a specific task. The advisor works very well for most of the accelerator. When the startups get near the end of the accelerator, when they know what they're doing and when they're going to market, then we try to pick the right mentor.

We have one team that's doing weather, micro weather for drones. Because drones need certain weather predictions that airplanes don't have. The perfect mentor for that team is someone from AccuWeather, a mature weather company that is in the industry and can really help this startup. But bringing that mentor in too early is just wasting people's time. We really try to wait to find the exact right mentor when the company is as mature as we can get it. Then we do a signed agreement and say the mentor will meet this entrepreneur four times a month, for four hours a month and the entrepreneur will be available four times a month, for four hours. This is not a binding contract, rather just a signed agreement that they are going to be there for each other.

What we found in the past is that we introduced two people and thought there was a mentor-protégé relationship, but we checked back in six months later and found out they had met twice, and then it fizzled out. Mentorship is unpaid, but they're free to do their own deal. If it turns into a lot of hours, the mentor might charge the entrepreneur, but it's not what usually happens.

Considering that mentoring comes up later in the process, do you do any workshops or education at the beginning, in the first three acceleration months?

Yes, it's all intense. We have a business planning process that I brought to the incubator, called integrated business planning and it has 12 elements. For instance, market segmentation, price, solution, cost, design, distribution, etc.

We teach the entrepreneurs each element and what they should do. We make the entrepreneurs do their homework, do their research, and bring us back some data, and we put that into their business case. At the same time, we do a workshop, we bring an expert to speak on the topic, and then we do a workshop to reinforce the topic.

Let’s take “pricing” as an example. We have a workshop on how to price your product, how to do multi-step distribution, how to do four price points, MSRP, and all the way to discount and down to the wholesaler. Not only are we teaching that in the morning, but we are doing a workshop in the afternoon and we might even have a speaker that is very successful on some sort of product that went through distribution with multi price points. In the three months, it is all tied in just like that.

11 Podcasts for Startup Founders

In the very busy world of startups, learning can often fall to the bottom of the priority list. However, the speed of learning and adapting are some of the main advantages a startup can have in this highly competitive world. So how do you manage your business and grow as a founder when your time is spread so thin? A good solution we found are podcasts. And the great news is that there are many podcasts for startup founders out there that tackle all aspects of startup life, from the first idea to scaling your business.

Podcasts are one of the best ways you can keep up to date with the latest trends, strategies, and tactics. They are also a great way to get to know how investors think and how other startups approach challenges.

Here are some of the podcasts for podcasts for startup founders that we listen to on a regular basis:

1. Masters of Scale

Masters of Scale is a great source of information, valuable insights, and success and failure stories. This is one of the great podcasts for startup founders and it has some serious production behind. The host, Reid Hoffman, shares his theories about scaling and debates them with his guests. As both an entrepreneur and an investor, he is one of the most qualified people to shed a light on the stories of famous founders. Reid Hoffman is a partner at Greylock Partners and Co-Founder of LinkedIn. He serves on the boards of Airbnb, Convoy, Edmodo, and Microsoft.

Good episode to start with: Handcrafted with Brian Chesky, Co-founder & CEO of Airbnb

2. This much I know

Listen on Soundcloud or YouTube

This much I know is the podcast of Seedcamp, Europe’s seed fund. It is hosted by Carlos Espinal and in it you will discover the stories of founders, investors, and tech greats. While data may not be always the focus, both founders and investors can extract valuable information from the discussions. Founders can learn how other founders think, how they approach their business and their market, and get advice from the people who have already been through it all. Investors can learn about today’s generations of founders, how they manage their businesses, and find out what’s new with investments in Europe. This much I know is one of the most valuable podcasts for startup founders today.

Good episode to start with: Patrick Campbell, CEO at Price Intelligently, on buyer personas and knowing your customers

3. The Pitch

Gimlet Media has produced a gem for the startup world and a great addition to our podcasts for startup founders list. They created a podcast where each episode features a startup founder who delivers a pitch to investors in order to get funded. For first time entrepreneurs, this podcast can offer insight into how other founders approach investors, how they sell their idea and make others believe in it. But the most valuable insights to take away are what investors look for in a business and what is an absolute deal breaker. If you are preparing to pitch for the first time, binge on this podcast before your big day.

Good episode to start with: When Less Is Not More: Hyde Closet

4. This Week in Startups

Not surprisingly, This Week in Startups is a mix of startups news and stories. Like many podcast hosts, Jason Calacanis has focused on interviews with startups and investing personalities. The episodes are filled with valuable insights, especially if you look beyond the surface of what is being said. Eight years of interviews have resulted in a lot of material neatly organized into categories. You will find podcasts on healthcare, transportation, startup basics, and many more, so you can choose just the subjects that interest you most.

Good episode to start with: Pitching to avoid being pigeonholed, expanding in slow markets, scaling past grass-roots beginnings, marketing beyond traditional channels & more

5. Equity Podcast

TechCrunch has a podcast. We are fans of their articles and their insights, but this podcast is pure gold among the podcasts for startup founders. It is venture capital-focused and it is a great resource for anyone who wants to be up to date with the latest business headlines and what they mean. For aspiring VCs and for first time founders, it can be a good place to get familiarized with the business world in general.

Good episode to start with: Raising in a recession with Unshackled VC’s Manan Mehta

6. ChartMogul SaaS Open Mic

ChartMogul, a data-curation company, launched a podcast that hosts SaaS founders and leaders debating everything SaaS related. From how to price your SaaS product and how to choose the right metrics to scaling customer feedback and going global, the podcast is filled with valuable commentary and actionable advice.

Good episode to start with: Alex Delivet on single-handedly founding the B2B Rocks conference

7. Data Stories

While it is not a startups specific podcast, Data Stories features talks between Enrico Bertini and Moritz Stefaner and their guests about the latest developments in data analytics, data visualization and related topics. Data Stories is great if you want to understand why data is important in general and how you can use it to serve your purposes. For startups and investors, looking at data is a must. Data gives you the health chart of a business. But spreadsheets can become difficult to follow especially when reviewing large numbers of them.

Good episode to start with: Future Data Interfaces with David Sheldon-Hicks

8. a16z

The podcast of Andreessen Horowitz, one of the biggest and most successful VC firms, is a mandatory addition for anyone interested in startups and investment. They tackle subjects ranging from investments, startups, and new tech, but they cross well over the Silicon Valley boundaries. Each episode offers great information, entertaining conversations and features big names. As far as podcasts for startup founders go, this one is great for founders who want to be up to date with everything new in the world of startups and investments.

Good episode to start with: The Truth about 1000 True Fans + Pricing Our Attention

9. Traction

Jay Acunzo and Tim Devane are the hosts of Traction, a podcast dealing mostly with how startups start. NextView Ventures, the seed-stage VC behind the podcast, has made a great decision to educate future founders in the many methods of getting their startups off the ground. However, this is not one of the usual podcasts for startup founders as it features rather unconventional approaches to startup success. The podcast features some delightful stories from founders, execs, journalists, and investors.

Good episode to start with: Data Science & Inventing the Future (Hilary Mason, Fast Forward Labs)

10. The Early Stage Podcast

This podcast is all about startup launches, raising funds and growing their teams. The host is John Valentine, Manager of Technology Identification and Communications at Thales, a worldwide leader in aerospace, space, defense, transportation, and security. He mostly interviews entrepreneurs at the Seed and Series A stages of their startups and founders can learn a great deal from their stories.

Good episode to start with: Maher Damak @ Infinite Cooling

11. Startup School from Y Combinator and Bonus: Y Combinator Podcast

Listen to Startup School lectures here

Listen to Y Combinator Podcast here

The Startup School lectures have been made available as a podcast and you can listen to it any time you want. It is one of the best one you can find out there, and while it has not been recently updated, it offers great, to the point, actionable advice.

The Y Combinator Podcast features entertaining talks with the people who are shaping the future. The accelerator that provides seed funding for startups has created a show about technology, business, research, and art. Definitely a great way to end our podcasts for startup founders list.

Good Startup School episode to start with: Modern Startup Financing by Carolynn Levy

Good Y Combinator Podcast episode to start with: Jessica Livingston on How to Build the Future

We hope you will find some good insights and even solutions to some of your challenges in the podcasts we recommend. Most hurdles have been already faced by others before you, even if their business differs from yours. There is always something new to learn in the world of startups and investing.

Other useful articles for startup founders:

- Building a Bulletproof Startup: Business Model Canvas vs Lean Startup vs Disciplined Entrepreneurship

- The Problem Statement Canvas for Startups and Innovation Teams

- How to Create a Persona and an End User for Your Startup

Keep the Main Thing the Main Thing: A Guide to Implementing OKRs and Building an Accountable Team

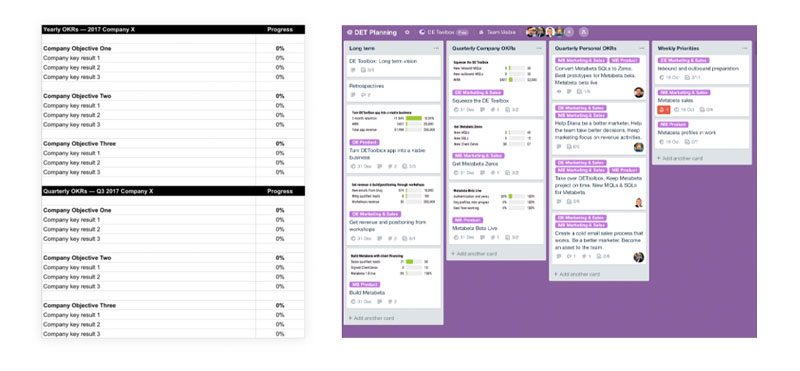

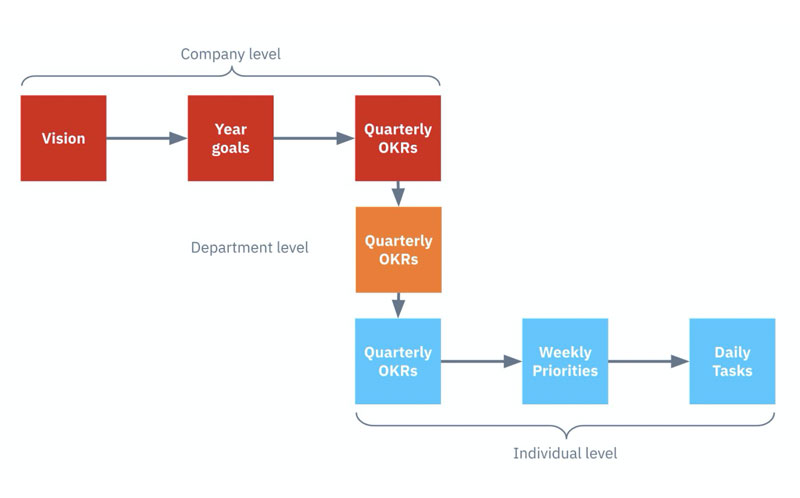

TL;DR: A startup can eventually pivot to a better market or a different product. It can get funded, can hire better people. However, without a healthy culture, everything will crumble. The healthiest culture is a culture built on accountability and operational excellence, not on fancy values. One way to build accountability and performance from the start, and define the right culture, is to use Objectives and Key Results (OKRs). OKRs are a management performance framework, first created by Andy Grove at Intel and used today by Google, Twitter, and thousands of high-growth startups. This article offers a practical way of implementing OKRs, based on my 20+ years of experience as a founder, and on my many mistakes.

[wd_hustle id="6" type="embedded"/]

Contents

- Everything is about Phase Two

- Objectives and Key Results (OKRs)

- Yearly goals to quarterly OKRs

- Quarterly OKRs to weekly priorities

- Weekly priorities to daily tasks

- Routines

- Tools

- Lessons I’ve learned

Everything is about Phase Two!

Building a startup is much more difficult than building a traditional business. Any tech founder knows it. The tough part is that, in most cases, the startup not only faces uncertainty, but insufficient resources, entrenched competition, lack of experience, and many other challenges. Still, there is hope! Uncertainty can be fought through experimentation, resources obtained, go to market strategies devised, more experienced people hired. But, without operational excellence, the opportunity will be wasted.

I’m going to stop here, to share with you one of the best business lessons I have learned in the past ten years. It does not come from a serial entrepreneur who raised billions and billions of dollars, nor from a thought leader, or a known VC. It comes from a bunch of third-graders in the popular South Park TV series. Before you watch this short excerpt, let me give you a bit of context. The kids have to write an essay about business, so they gather at one of their homes, drink coffee, then end up staying late thinking about what they could write. While debating how they should approach the topic, a few gnomes come in the room. the gnomes open drawers and steal the kid’s underpants. Watch this for the rest of the story:

So what’s the lesson here?

Objectives and Key Results (OKRs)

What is your phase 2? How do you get from an idea to a successful, profitable business? Despite all the learnings, entrepreneurship and management are still more art than science, and subject to different mental models, cognitive and personal biases.

There are problems with all traditional management models—waterfall, agile, management by objectives, six sigma, lean startup—heck, you could even consider micromanagement an approach. Especially if it can help you break through the early stages. The downside is that the waterfall model can’t plan for uncertainty. Agile management is too short-sighted. Six-sigma will help you improve your startup process, but what if it’s the wrong process? Lean Startup is an excellent philosophy, but it encourages cognitive biases and a lack of accountability as a methodology.

All the traditional models have shortcomings when applied to a small startup organization, that’s why Objectives and Key Results could be a better fit for startups. Based on the management by objectives methodology, OKRs were first adapted by Andy Grove at Intel, then brought by John Doerr at Google, from where they spread throughout the startup world. Christina Wodtke, a former product manager and GM at LinkedIn, MySpace, and Zynga, further evangelized the methodology through her articles and books. (I recommend both Radical Focus and The Team that Managed Itself).

While there are as many detractors as there are supporters, I won’t get into that argument. I have implemented this and adjusted it over the past seven years in all my companies (Grapefruit, Eternime, Exploratorium), and with tens of startups at MIT, Singularity University, Techstars, and other accelerator programs. It just works. Here’s how.

An OKRs implementation guide

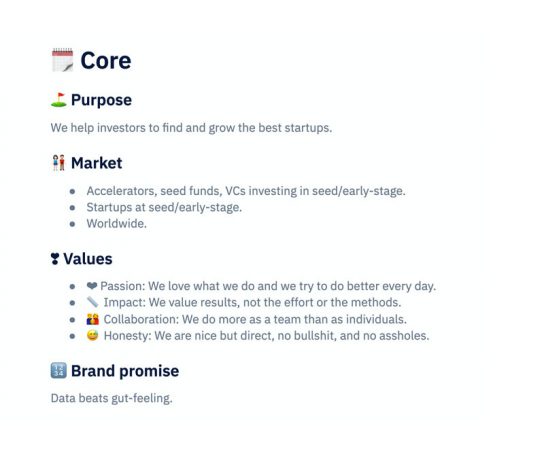

Now it's time to get your hands dirty. This is exactly how we do it at Exploratorium (the startup organization that builds DE Toolbox and Metabeta). It is one of our essential processes as it helps us move together as a team from the vision to why it finally works. It helps us move from a long-term vision beyond ten years to the hard question of what we should do today, then it allows us to be accountable.

Our process has two essential parts:

- The model we use to zoom in from a 10-year visionary horizon → to a medium-term (3-year) horizon → to yearly goals → to quarterly OKRs → to weekly priorities and, finally, → to daily tasks.

- The routines that keep this process on track.

From vision to yearly goals

Our long term vision is simple and expressed on one page:

We help investors to find and grow the best startups. We do this by focusing on data-driven decisions, not only on gut feeling.

Let's descend from the high clouds of visionary thinking and get down to numbers. How does this look? A clear finish line supports our vision—our exit strategy. What’s yours? Forget the IPO (less than 0.2% of surviving startups go public) and be realistic. I have to admit that I did not have an answer the first time I was asked this question by an investor, back in 2005. Thank you, Konstantinos, for this very important lesson.

Let's descend from the high clouds of visionary thinking and get down to numbers. How does this look? A clear finish line supports our vision—our exit strategy. What’s yours? Forget the IPO (less than 0.2% of surviving startups go public) and be realistic. I have to admit that I did not have an answer the first time I was asked this question by an investor, back in 2005. Thank you, Konstantinos, for this very important lesson.

Ten years is enough to reach most of the ambitious goals. How do ten years from now look for you and what are your goals? What does a closer success look like, in three years? Now is the time to get more specific. There is still a lot of uncertainty but the process is about breaking a tough task (find the pirate treasure) into smaller, more manageable stages (sail to the Caribbean and find the map, hire locals for help, and stack provisions).

Don’t get too specific—these milestones should be achievable. One important thing about this breakdown is that it helps everyone on the team understand our purpose. Where our ship is sailing, why, and what’s on the map.

From yearly goals to quarterly OKRs

We used to define OKRs at a yearly level. Mature businesses do plan in yearly cycles and objectives, but we still have a lot of things to learn, sod we realized that being very specific gives us a false sense of certainty. So we keep the yearly objectives still very broad. This changes when we get at a quarterly level. It is a very close horizon that allows us to be specific. Very specific.

We set one Objective (which has to be inspirational, not SMART). This is our North Star for the quarter and everyone on the team can rally behind it. The next question, “How do we know we’re there?” gets us our Key Results—three measurable outcomes of the quarter. The rule here is this: one Objective and three Key Results. No more no less (in the wise words of Master Yoda). There is a rationale at the end of this article if you have the patience to continue.

There are a lot of ways to formulate the Key Results (this website has some good examples for all business areas). Here are my suggestions:

- Key results should be expressed as results, not tasks.

- They should be measurable (i.e. countable or with a specific deadline).

- Their progress should be measurable (i.e. it’s not an on/off thing).

- They should be stretched. You can easily evaluate this by measuring your confidence level for attaining them. It should be 50% at the start of the quarter. Reaching 80% of the Key Results is considered a good outcome.

- Key Results should cover the three most important areas of your business at the current stage (in our case product, sales, and marketing for the current quarter).

- They should be very clear, concise, and simple.

- Don’t cram two Key Results in one (eg. 1,000 new customers and 10 advertising campaigns). Choose the most important one. Stick to the rule of three.

Implementing OKRs is the job of the founders. It’s not easy to decide what’s important now and leave aside all the things you want to do. Still, the path to failure features a lack of focus.

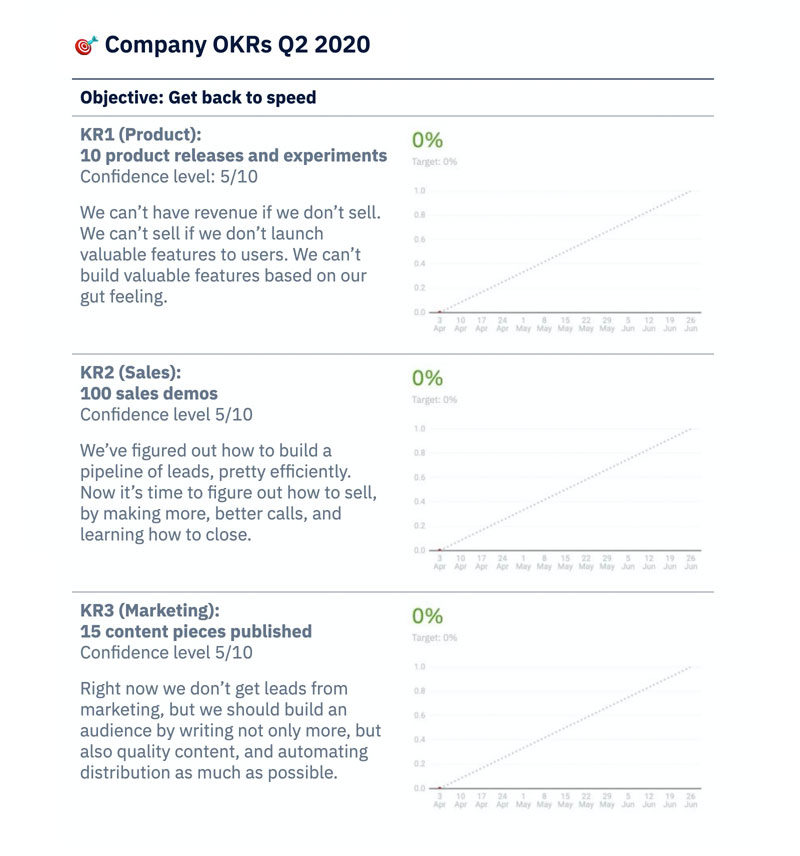

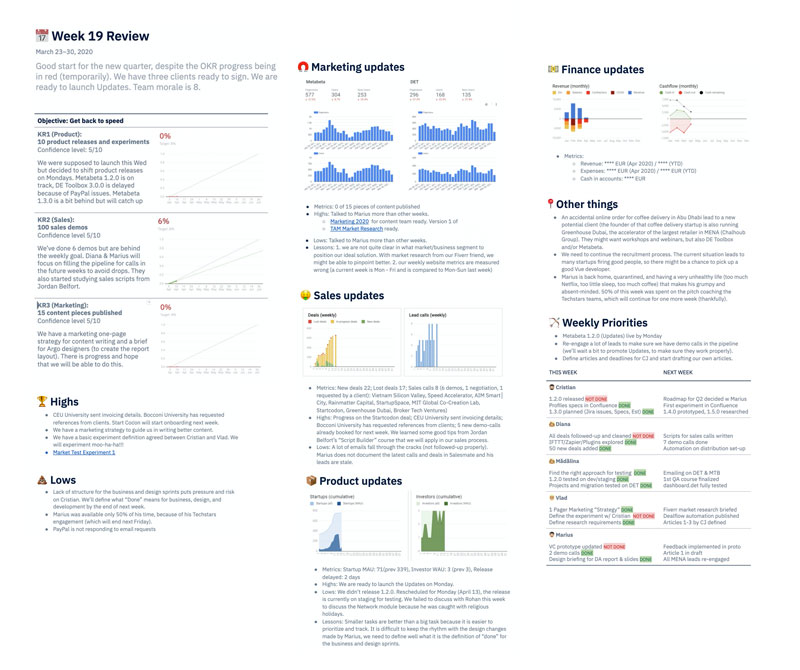

These were the company quarterly OKRs.

[wd_hustle id="6" type="embedded"/]

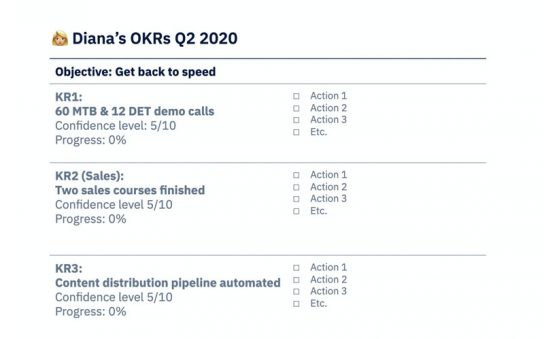

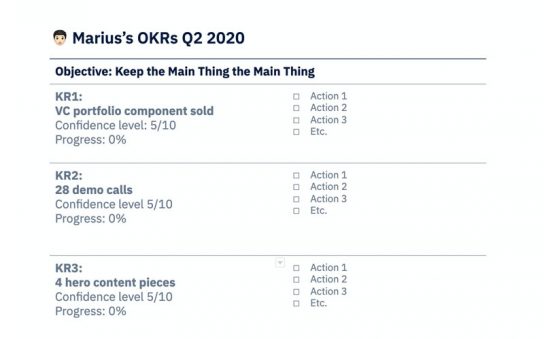

Individual quarterly OKRs

If your team is big enough (16+) you may choose to have departmental OKRs derived from the company OKRs and only then move to individual ones. Otherwise, for the sake of simplicity and against bureaucracy, go to the individual level.

The same general rules apply to your individual OKRs as for your company OKRs. However, there are some specific aspects of individual OKRs that I’ve learned the hard way. Hopefully, you won't have to. Here they are:

- They should be decided by the individual. That’s where accountability comes from. You can’t have it without delegating decisions. The only thing you can ask is “How does this support reaching the company’s OKRs?”. I can’t stress this enough. It is perhaps the most important rule of implementing OKRs.

- The OKRs should be related to the team member’s everyday job. Extracurricular things don’t work (like studying something, getting certifications, non-essential projects). I often get the question “What should the person do first, OKR-related stuff, or daily-job-related stuff?”. If you’re asking this thing, OKRs are not set the right way. Don’t set your team up for failure. Focus on implementing OKRs right.

- They should be decided in a common meeting, where everyone should be confident that by putting together their individual OKRs, the company OKRs are achievable. Let your team discuss and explain to you how the team as a whole will get there.

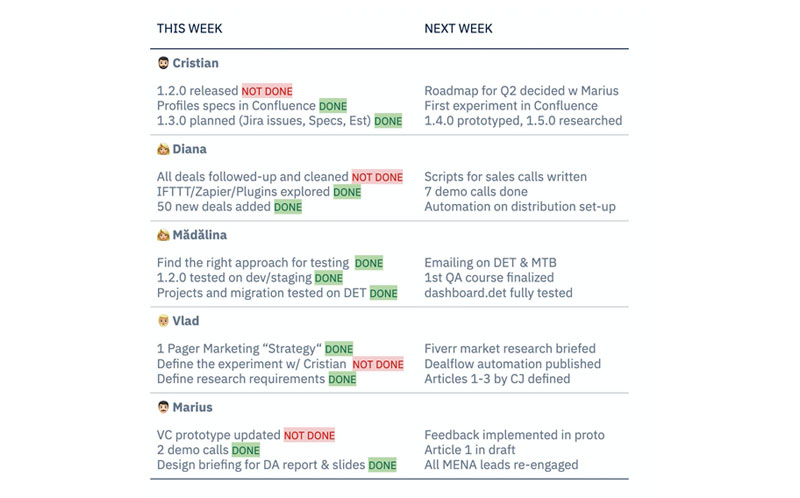

Quarterly OKRs to weekly priorities

Let’s assume we decided on the following. By the end of this quarter, we’ll set sail to the sky-blue seas of the Caribbean (that’s the Objective). As Key Results, we need a 15-ton sailing ship ready to leave, a team of 20, and have raised 15,000 doubloons (to be honest I have no clue of the exchange rates to date). My Objective as a captain would be to get the expedition funded. My Key Results would be Key Result 1: at least 10 ships reviews before securing one; Key Result 2: two senior pirates hired by mid-quarter; Key Result 3: 50 fundraising meetings to secure the money.

The question is, “what do I do this week”?

This week me (and every other pirate), will choose three priorities (or results) to achieve. Not tasks. Unlike key results, which are progressive, these priorities should be binary, meaning that, by the end of the week, they are DONE or NOT DONE—“There is no try”). These priorities should help people make one more step towards reaching their quarterly results.

Some guidelines:

- The tendency here is to express them as tasks. “Contact all sales leads”, “Publish 10 social media posts”. This leads to the false impression that the priority has been (almost) achieved by the end of the week. I insist on changing them to outcomes. “All sales leads contacted”, “10 social media posts published” etc. to encourage accountability.

- All have to be connected to individual OKRs, otherwise, they might not be a priority.

- Of course, everyone decides for themselves, but everyone in the team should easily see these priorities.

From weekly prioritization to daily tasks in implementing OKRs