This article is focused on deal flow challenges and is part one from a series of insights drawn from 50 in-depth interviews taken over the past two years and 126 responses to a survey we sent out recently. To better understand our process and the methodology behind these findings, make sure to read Disciplined Accelerator: Introduction.

Findings

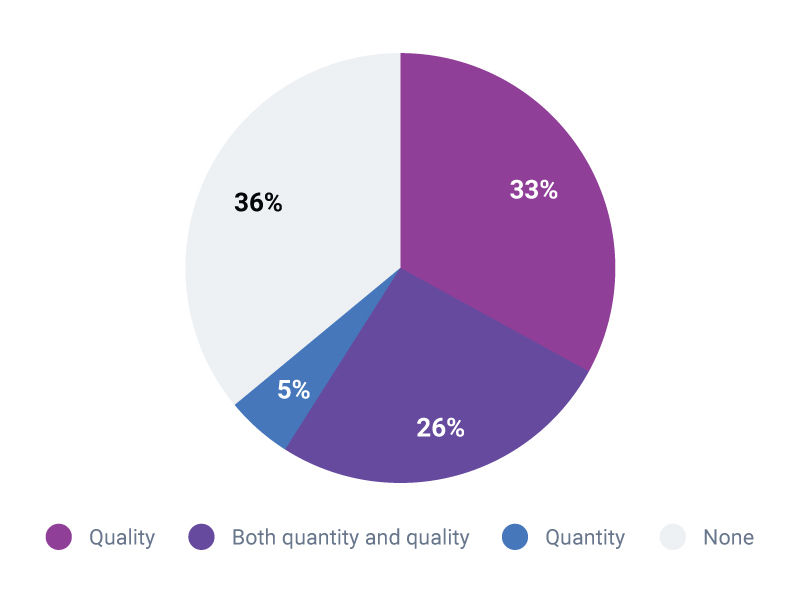

- 2 out of 3 accelerators we’ve talked to have deal flow challenges.

- 59% of all accelerators get low-quality applications. 31% don’t get enough applications. 26% of all accelerators get both insufficient and low-quality applications.

- Reasons for these challenges are lack of awareness and reputation (especially for new accelerators), competition (with other accelerators, investors, grants or various startup programs) and unbalanced offering (cash vs. equity).

- Accelerators offering $100,000 or more in funding have fewer deal flow challenges. On the other hand, the ones offering less funding have quality issues (startups don’t perceive the mentoring and support as bringing enough value to justify the amount of equity).

- Marketing budgets are too limited to allow being effective on all fronts (awareness, trust, lead generation, qualified staff).

- Applications coming in as a result of marketing campaigns are of much lower quality than the ones coming in from mentor/partner recommendations.

Over 70% of our deals come from introductions from our mentors or overall network, not by marketing efforts.

— Les Schmidt, BRIIA

Thoughts on deal flow challenges

- Ongoing scouting: Getting better applicants starts long before promoting your new program. The advice you give to your startups to GOOB (get out of the building) applies to you too. Conferences, meetups and other events are a good place to connect to good startups. Be proactive about it and set metrics for your team. The good old days when startups applications flooded every accelerator program are gone. Competition is fierce for top startups. Even though you’re part of those lucky 33% accelerators without deal flow problems, scouting can only increase the quality of your deals and the size of your network.

- Build a stronger network: Many accelerators don’t have the YC luxury of getting more applications than you can handle. In many situations (one example is Thailand’s ecosystem, driven by corporate accelerators), the number of applicants is often too small to get a decent quality across your cohort. Therefore, recruiting through referrals and recommendations is a much better source for quality, vetted deals.

Going to events not only for networking but to give back is important. All startup communities are local, so you have to give back to the community—this is why, for us, 80% of the deals came through recommendations.

— Cosmin Ochișor, former Hub:raum Krakow WARP, now partner at Gapminder. - Involve your network in the deal flow: Mentors are some of the best deal sources. Involving them in generating deal flow (beyond sending an email begging for them to share your marketing page) and in judging/vetting will bring a lot more value in the process—often much higher than what your small team can handle.

- Go beyond Google forms and emails: Use a CRM to handle the deal flow. Of course, we would recommend Metabeta, our portfolio & deal flow suite, but Hubspot, F6S, and Gust are also good alternatives to generic forms. They allow you to involve external judges and have all the information available in one place for your team.

Try a better deal flow tool

- CRM created for accelerators and investors.

- Collaborate with your team and judges.

- All messaging in one place, and more...