Burn rate is one of the most critical metrics that any early-stage startup should be tracking. It shows the amount of cash leaving your company’s bank account each month. There are two types of burn rate:

- Gross Burn Rate is the total amount of operational expenses a company has each month (money you spend)

- Net Burn Rate is the amount of money from the outgoing cash flow after deducting incoming cash flow (money you lose, or negative cash flow).

How to calculate it

Gross Burn Rate = Cash out from Operations

Can also be calculated as Cost of Goods Sold (COGS) + Operating Expenses (OPEX. If expenses are paid in the same month they are accrued.

Net Burn Rate = Gross Burn Rate – Cash in from Operations.

Example: If you have €3,000 money coming in each month, and spend €10,000 each month, your Gross Burn Rate is €10,000 (the amount of money the company spends each month), but your Net Burn Rate is €7,000. This means that, if you have a total of €50,000 in your bank account, that tells you that you have 7 months left before you run out of cash.

Note that you need to look at operational expenses and usually exclude one-off revenues or one-off expenses. If a company has payments made in advance but expenses start later on (like in the case of selling an MVP before building it) this will result in a small rate in the beginning and higher rate later on.

This needs to be tracked on a monthly basis, although some might say that weekly check-ins are required if the startups is really early stage with few cash reserves.

Where to get this data

Where to get this data

The company’s cash flow statement, which a founder should get monthly either from the accountant, or from finance platforms (Quickbooks, Xero, ThinkOut, etc.)

What decisions is this helpful with

Metrics shouldn’t just provide information about the company, they should drive decision making.

- Both founders and investors use Gross Burn Rate to benchmark a startup against other similar companies. This shows if a startup overspends or if it is efficient compared to others. That way the founder can decide how to optimize expenses.

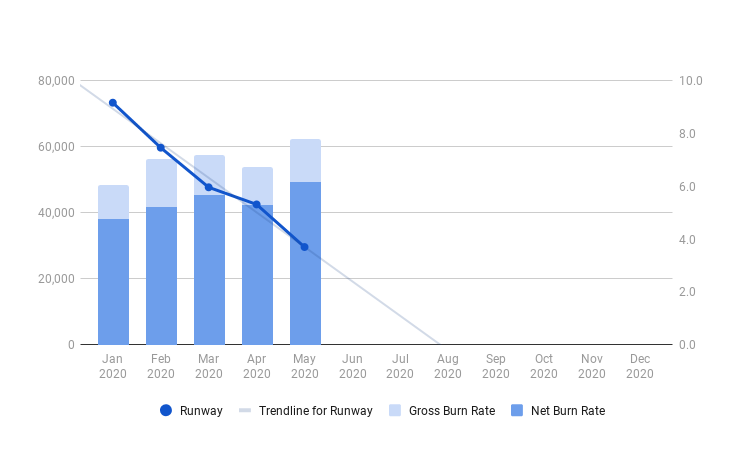

- Founders use the Net Burn Rate to calculate the runway, meaning how long they are still able to remain in business. Runway is calculated by dividing total cash in the founder’s bank accounts by the Net Burn. This helps them decide whether they should start fundraising to extend that runway or cut non-essential costs.

- Investors use the Net Burn Rate and Runway to know how much money the startup needs and how much in a rush they are. If the startup has €1M in the bank and a Net Burn Rate of €250k, that means that they’re burning through cash fast and will run out of money in 4 months. They will need to invest at least €4.5M to extend their runway for 18 months (the average taken into consideration). This information also offers leverage to the investor in the negotiation (if the runway is short) or to the startup (if the runway is at least six months).

Benchmarks for burn rate

- “Your value creation must be at least 3x the amount of cash you’re burning or you’re wasting investor value.” — Mark Suster

- What burn rates are good or bad varies a lot, but a good indicator is the time a startup has left. Typically, a founder should be able to see 12 months ahead.

- Some startups choose to focus on taking on a new market and have big burn rates with zero revenue, growing from one financing round to another. According to Mark Suster, as an early stage startup, you need to ring the freaking cash register. That means to monetize your business as soon as possible because 99% of the companies cannot afford to focus solely on growth.

- Danielle Morrill (ex-CEO & Co-Founder at Mattermark, current Growth Marketer at GitLabs) mentioned her burn rate at Mattermark was €150-200k. With $2.5M of funding in the bank this put them at 17 months of runway (all things remaining equal, 0 revenue growth and 0 spending growth). Her transparency led to other people opening up about their own rates in twitter posts, including Buffer CEO, Joel, which at the time (2014) had $914k in the bank, a gross burn rate of $240k (based on Fred Wilson’s rule of thumb) and MRR of $370k. Which puts him at zero net burn rate.

- Nathan Latka, the SaaS guy with a lot of data, gives some examples of companies and their burn rates in his article. For example, he says MedStack has raised $2.3m, is doing $56,000 per month in revenue and has total expenses of $156k/mo (gross burn rate of $156,000). Net burn rate is $100,000 per month and they have 23 months of cash runway left. This is fine. DaisyIntelligence has enough cash for 12 months of runway. They’ve raised $15m and do monthly revenues of $575,000. Total monthly expenses are about $1m meaning net cash burn is -$500,000 per month. These founders will either have to raise more capital in the next 4 months, drive enough new revenue to get to profitability in the next 12 months, or they’ll run out of cash.

Other useful resources:

- Why You Are Tracking the Wrong Metrics for the Wrong Purpose

- 4 Essential Metrics for Saas Startups

- 3 Essential Metrics for Marketplace Startups

Diana Niculae Grigorescu

Super awesome marketing girl claiming she is more chaotic than she really is.