Venture capital deal flow management tool

Evaluate new startups, track metrics and progress and create a digital network of mentors and support for your portfolio companies.

What we do

We bring startup stakeholders together and give them an venture capital management software to collaborate faster and smarter.

Startup founders

Investment analysts

Fund partners

Due diligence partners

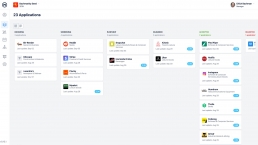

Modules available in Metabeta accelerator management software

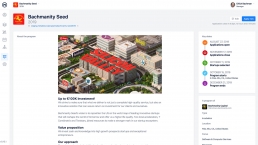

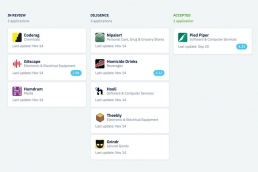

Dealflow CRM for Venture Capital Teams

Specialized pipeline built for startup focused investment funds, standard investment brief formats, email automations, deck and video attachments, and more.

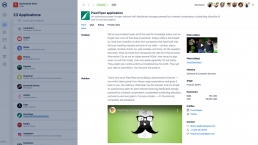

Messaging features let your team communicate and store all conversations with startups in one place, but also add private notes visible only to your staff.

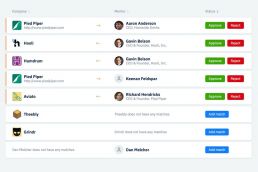

Collaborative dilligence process lets you invite external reviewers or experts to evaluate deals using a set of weighted criteria, in line with your investment thesis.

Metrics & Reports

Scheduled reports ensure that you keep up to date with your startups, using custom-defined report templates on a weekly, monthly or quarterly basis.

Metrics tracking Coming soon keeps you and your startups focused on key metrics, while having a clear overview of growth and a historical track record.

Access groups let startups share updates in real-time with whomever they wish (advisors, investors, board members), while having full control over who sees what.

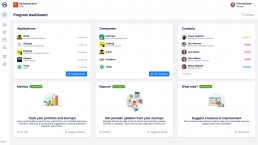

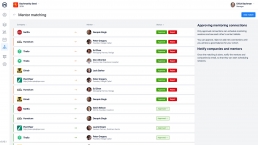

Mentor engagement

Mentor pool keeps all your mentors and experts in one place, from where you can add them to individual programs.

Mentor matching allows mentors and startups to discover and request to be connected with each other, while giving you full control over the final matching.

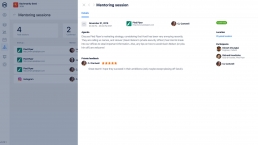

Session scheduling and feedback offers a high-level overview of how the mentoring process works and lets you see average ratings and feedback for each mentor or startup.

Let us show you how our venture capital deal flow management software can help you better manage your startup portfolio!

Full feature list

Deal flow & process management tools for your venture capital team and internal processes.

Multiple workspaces

Have separate workspaces for each program or fund, then see the big picture in your organization's workspace.

Team access

Manage who has access to your organization workspaces, by adding members as managers or regular staff.

Dealflow pipeline

See all incoming deals (including drafts) in one pipeline per program/fund, accessible to all your team.

External diligence

Get external expertise by inviting anyone outside your organization to access and review individual deals.

Deal messaging

Keep all relevant communication related to deals in one place, and notify everyone of new messages.

Private notes

Communicate with your team on each deal, but keep the private messages only for your management and staff.

Mentor matching

Allow mentors and founders to see each other's profiles and manage all the matching requests in one place.

Session scheduling

Both mentors and startups can schedule mentoring sessions, get reminders, and keep meeting notes and agendas.

Mentor rating

Get feedback and rating for each mentoring session, then see the average ratings for each mentor or startup.

Diligence checklists Coming soon

Define checklists for the diligence process and track each deal through the process more easily.

Startup updates Just launched!

Configure the reporting templates and frequency to get periodic updates from your portfolio startups.

Metrics tracking In Beta

Define metrics at portfolio or program level, then see real-time updates from your portfolio startups.

Data room In Beta

Share files securely with your staff and each startup, fully integrated with Google Drive and Dropbox.

Fund management Coming soon

Manage relationships and reporting with your team, LPs, and partners, allowing restricted access to information.

Integrations In Beta

Connect with more than 1,500 applications and data sources using Zapier or API access (premium plans).