Monthly Recurring Revenue (also known as MRR) is the amount of recurring revenue subscription based businesses are making each month. It’s an essential metric for SaaS businesses, even though it is not technically approved by the GAAP (Generally Accepted Accounting Principle) or IFRS (International Financial Reporting Standards). Keeping an eye on the MRR helps founders forecast the company’s growth, model financial projections and understand present performance. It’s also a key metric that investors like to look at.

How to calculate Monthly Recurring Revenue

Before we get into formulas, examples and benchmarks, let’s talk about the various forms of Monthly Recurring Revenue that need to be tracked separately to get that realistic and correct view of the company’s performance. MRR is only top-level and complex businesses need to dive deeper into the variations of this metric. Having a granular look, founders can better identify the key drivers of their business.

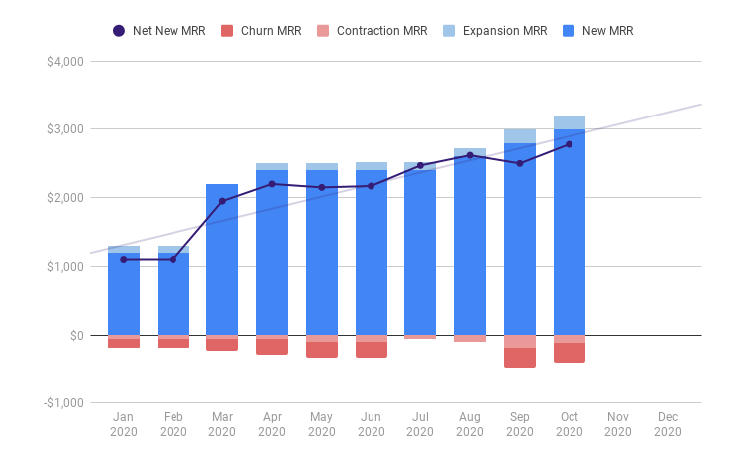

- New MRR is the revenue that comes from new customers sign-ups.

- Expansion MRR also known as upsell or upgrade, is the revenue that comes from selling something extra to your existing customers. Think new features, extra users on a plan, upgrading to more powerful plans etc.

- Contraction MRR is the lost revenue because the customer downgrades to a cheaper plan.

- Churn MRR is the revenue that is lost from cancelled subscriptions.

The simplest calculation for startups in the early stage would be adding up all recurring revenues or multiplying the number of customers by the Average Revenue per User.

MRR = Number of customers × Average Revenue per User

For example, if you have 3 customers, two that paid $80, and one that paid $1,200 for a yearly subscription, you have an MRR of (2x$80) + ($1,200/12) = $260. The ARPU would be $87.

The safer calculation takes into account all the variations of MRR, as follows:

Net New MRR = New MRR + Expansion MRR – Contraction MRR – Churn MRR

For example, let’s say you have 5 new subscribers for the $49 plan, 2 that upgrade to the $79 plan, one that downgrades from $79 to $49, and 3 that cancel their $49 subscription altogether. That means that Net New MRR = 5x$49 + 2x$30 – $30 – 3x$49= $128.

VCs are more inclined to look at MoM Growth ( the month-over-month growth with which the revenue increases) in their evaluation process, so here’s how you calculate that:

MRR Growth Rate (%) = Net MRR Month B – Net MRR Month A / Net MRR Month A × 100

Guidelines for collecting the data accurately

As straightforward as this metric is, there are still common mistakes made when collecting the data.

- One-time fees need to be excluded. This metric tracks the recurring revenue and not the cash inflows.

- Discounts need to be included in the calculation. If you’ve given your $100 plan for $80, make sure to put in your tables/programs the actual money that you’re making ($80) not the value of the plan the customer signed-up for.

- Reactivation from older customers should not be counted as a new MRR necessarily. For better performance analytics, if this happens often, it makes sense to create a separate category just for this, Reactivation MRR.

- There is a difference between billing and cashflow. Yearly plans are paid upfront and billed early, however, the full amount should not be inserted into the table as a one-time fee in the month it was paid. That amount needs to be split across 12 months for an accurate MRR.

- Trials should not be included in the table until after they’ve converted into paid customers.

Where to get this data?

Most people use spreadsheets for tracking this data, or more advanced accounting tools that have this feature integrated into. As it’s not a GAAP recognized metric, some platforms do not have this feature (or have only top-level MRR, without the churn, expansion etc).

What decision is this helpful with?

- Founders can model financial projections and see how much they need to push to reach their projected goal. Usually this happens towards the end of the month. Based on this they can decide how to budget future expenses.

- Monthly Recurring Revenue is an important metric for sales, marketing and product teams. Salespeople are focused on getting new customers in, while marketing and product teams are focused on nurturing existing customers, upselling, cross-selling and making sure to keep a negative churn rate. According to a KBCM Saas Survey, 37% of new ARR bookings come from upsells & expansions and larger companies rely more heavily (~1.4x more) on upsells & expansions.

- It’s used in calculating the lifetime value of a customer (LTV or CLTV). Breaking down MRR into cohorts/plans allows founders, management or sales people to understand where the money comes in. For example, if a big chunk of the revenue relies on few enterprise customers, losing one customer will impact the MRR in a major way. This means that part of your focus should be on diversifying your cash intake sources.

- Investors look at your MRR and MoM growth to identify whether or not the company is healthy and sustainable. Variations in growth percentages are normal, so it’s important that founders do not report falsified info or made-up numbers. Good investors will see the overall picture and will know when there are discrepancies.

- Adjusting the pricing, as many software companies misprice their products.

Benchmarks for Monthly Recurring Revenue

- A good rule of thumb for SaaS companies raising series A is to have 15% MoM MRR Growth, according to Tom Tunguz, partner at Redpoint Ventures.

- According to Paul Graham from Y combinator, early stage startups should have somewhere between 3-5% MoM MRR growth each week, before raising seed or series A.

- Typically startups will have zero to slow growth in the very beginning when they’re still figuring out things and trying to reach product-market fit. After that, they will experience very high growth until they become big and growth becomes steadier.

- The Rule of 40 (which applies to more mature SaaS businesses) states that, at scale, a company’s revenue growth rate plus profitability margin should be equal to or greater than 40%.

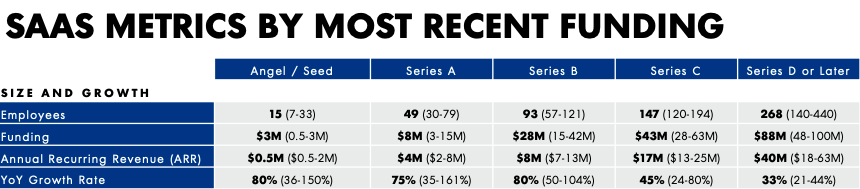

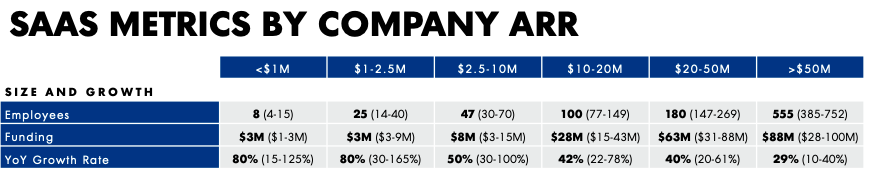

- Open View Partners (together with various other VC firms) compile a SaaS Benchmark report each year. You can download the 2019 one from here. Main takeaways related to MRR/ARR/Growth would be:

Conclusion

Monthly Recurring Revenue is an essential metric for subscription based companies and investors love to look at it because it shows predictability and performance. However, like many metrics, on its own, it doesn’t give enough insight. There are other essential metrics such as LTV, CAC or Gross Churn Rate that SaaS companies need to track for proper evaluation and to be able to make better decisions.

Other useful resources:

Diana Niculae Grigorescu

Super awesome marketing girl claiming she is more chaotic than she really is.