This article analyses how accelerator focus on a vertical affects the business, and is part two from a series of insights drawn from 50 in-depth interviews taken over the past two years and 126 responses to a survey we sent out recently. To better understand our process and the methodology behind these findings, make sure to read Disciplined Accelerator: Introduction.

Findings

- Today, there is an abundance of options for startups. This makes the competition fierce, so accelerators have to find ways to appeal to top startups. Specialization is the most common strategy to tackle deal flow quantity and quality.

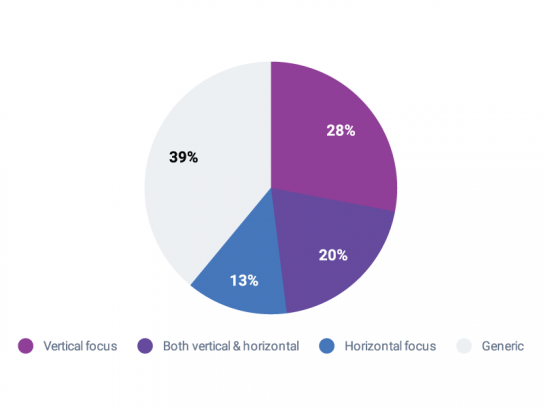

- Focusing vertically (on an industry), horizontally (on one or more disciplines, such as AI, blockchain, FinTech, etc.), or both is a strategic option aiming to improve the efficiency of the accelerator’s programs. Of the accelerators we’ve interviewed, 61% have a focus, 48% having a focus on one or more industries (at least).

- 87% of accelerators with a horizontal/vertical focus reported difficulties in getting enough applications. The narrower the accelerator focus, the fewer the applications. On the other hand, the quality of the applicants is much less of an issue.

Since we focus on specifically mediatech content tech startups the deal flow is very fragmented and it’s hard to come by good leads by standard deal flow tools and methods.

— Sten Saluveer, Storytek Accelerator

- Expanding or narrowing focus geographically helps balance the vertical/horizontal focus shortcomings. Roughly ⅓ of our respondents focus locally, another ⅓ focus regionally (across countries/states) and the rest ⅓ try to appeal to a global audience.

Thoughts

- It’s an assumption we will check further, but despite focus being an obvious strategic option for improving the deal flow, we believe that it has an inconsistent influence on deal flow. Focusing decreases the quantity of applications (already an issue) but increases the quality of startups (mostly because of better marketing positioning).

- Choose your focus based on your strategic assets: corporate partnerships, mentor and expert networks, other strong relationships, access to consumers or corporate clients, the availability of talent. Again, ask yourself what you ask your founders: what is our unfair advantage (something that cannot be copied or replicated) and is key to our success?

- Expanding across borders or even globally is a way to increase the number of applicants, but unless you have access to strong international networks (customers and partners), you won’t be able to further support your startups to reach their potential. So it might be more useful to adopt a few good cockroaches, rather than a delusive unicorn.

- Defining your accelerator focus won’t improve your top of the funnel (on the contrary) but it will improve the outcome of your accelerator programs.

Try a better deal flow tool

- CRM created for accelerators and investors.

- Collaborate with your team and judges.

- All messaging in one place, and more...