How to calculate Customer Acquisition Cost

To calculate the Customer Acquisition Cost add up total expenses related to sales and marketing activities and divide that by the number of new customers signed. What you should include in those expenses:

- Salaries of marketing & sales staff (including payroll taxes)

- Advertising costs

- Marketing collateral production

- Sales-related travel expenses (sales staff or management who travel to clients or trade shows)

- Subscriptions to tools such as Hubspot, Salesforce, etc.

CAC = Sales & Marketing Expenses / Number of new customers

For example, if a company spends $20,000 on marketing and sales activity in a set period of time, and that results in 20 new customers, then CAC = $20,000/20 = $1,000.

However, this mainly tells you only how much you spend. There are two other metrics connected to the Customer Acquisition Cost that are tracked in relation to it and that give better insights into how the company is performing.

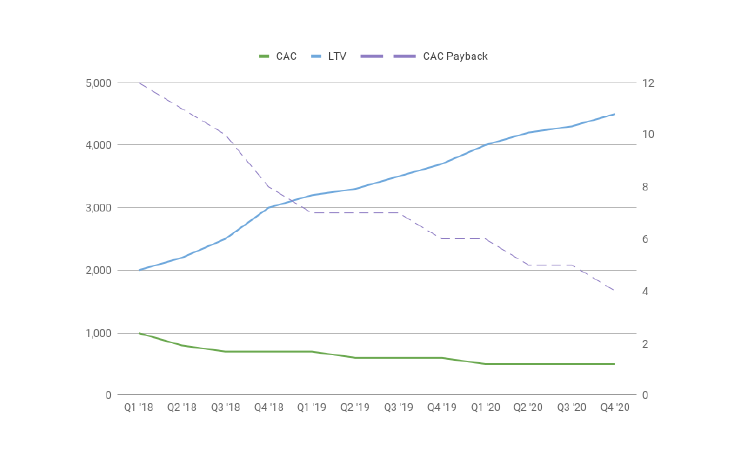

LTV:CAC ratio

LTV:CAC ratio is the ratio between what it costs to acquire one customer and the value that the customer brings to the company over its lifetime. For subscription-based businesses a customer once won is expected (ideally) to return. That means that, over time, you can win more from that customer, with little to zero cost to acquire him.

Customer Acquisition Cost Payback (CAC Payback)

CAC Payback is the amount of time in which a business recovers the money it spent to acquire its customers. Let’s say that you have a CAC of $1,000 but you gain $50/month from that customer you just acquired. That means that it will take you 20 months to recover the money you spent on getting that customer on board. Usually, that’s too much, which drives decisions to cut or optimize CAC. I’ll discuss decisions and common benchmarks later on in the article.

Guidelines for collecting the data accurately

- A common mistake is looking at all the costs of advertising, but not at the people working on them. Salaries of all the sales & marketing people are part of the Customer Acquisition Cost, alongside all the other expenses listed above.

- Most startups use tools to automate processes, aggregate data or analyze performance. Whether it’s a CRM that tracks leads and sales conversations (like Hubspot or Salesmate), a calendar tool (like Calendly or mix.ai) to schedule meetings or a social media planner (like Buffer). All subscriptions for tools that handle parts of marketing & sales operations are always part of the CAC.

- Sales cycles differ from business to business. Usually, B2C < B2B < B2G. That means that money spent now will yield results later. Founders that can track the sales cycle of their business should consider its impact in the overall calculation of their CAC.

- When analyzing the performance of different ads, do not take organic reach into account.

- Break down the marketing expenses into separate channels and track how each is performing.

Where to get this data?

- Accounting software for staff salaries & travel expenses (Quickbooks, Xero, Freshbooks),

- Analytics tools (Hubspot, Facebook Ads Manager, Google Ads)

- Customer/Product analytics for the number of new customers (Segment, Mixpanel, Amplitude)

What decision is this helpful with?

- Knowing the CAC helps with budgeting. Segment the different channels used to get customers (either Google Ads, backlinking, cold emailing, etc) and track them individually. That way you can see which is performing better and allocate the M&S budgets accordingly.

- The LTV:CAC ratio (explained above) tells founders and investors what to expect on the ROI (Return on Investments) front. More specifically, it tells them when the company will break even and start getting profitable.

- Cost-cutting is not the only way to optimize the LTV:CAC ratio. Lowering costs helps with downsizing the number of months in which you should recover the money (i.e. the CAC payback). However, there are plenty of decisions a founder can make to gain CAC efficiency. Try increasing the Annual Contract Value of a customer through up-selling or cross-selling to them.

Benchmarks for Customer Acquisition Cost

There are variations on what a healthy Customer Acquisition Cost is. It depends, like most things, on the type of business model, the stage the company is at, and other essential metrics that founders need to track. When benchmarking, try to look at companies similar to what yours.

- “The common metric of sales plus marketing expense equals first-year ACV is a useful yardstick for SaaS businesses that are truly in the scaling phase, but you’ll need to modify it to match the cash coming in, and the cash on your balance sheet, to make it really work for your SaaS business.” — Jason Lemkin, Investor, and Founder at SaaStr Fund

- Businesses ideally want LTV to CAC ratio to be over 3 and CAC payback in under 12 months.

- Jordan Mayes benchmarked 50 SaaS businesses from the BVP Cloud Index. He found out that upper quartile businesses have a CAC of 1.52, the 2nd quartile 1.79, and the lower quartile 2.43. You can see the breakdown of that CAC Analysis here.

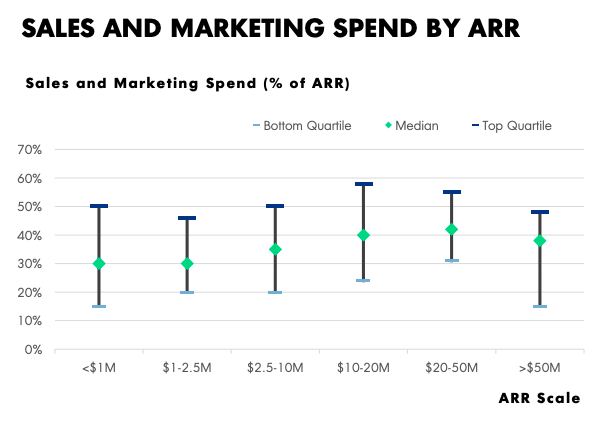

- “Sales and marketing spend are a SaaS company’s largest areas of spend after they hit $2.5M of ARR, before that it is R&D. Sales and marketing spend peaks when companies are scaling through Series C / D.” — Open View Report, 2019 Expansions SaaS Benchmarks

Other useful resources

Diana Niculae Grigorescu

Super awesome marketing girl claiming she is more chaotic than she really is.